At the annual conference of the British Water Cooler Association (BWCA) held on 14 March 2013, Iva Hatzold, a research analyst from Zenith International, stated that the market had declined from £115m in 2011, and that a further decline was expected in 2013 and 2014, but would take off again by 2015.

At the annual conference of the British Water Cooler Association (BWCA) held on 14 March 2013, Iva Hatzold, a research analyst from Zenith International, stated that the market had declined from £115m in 2011, and that a further decline was expected in 2013 and 2014, but would take off again by 2015.

Also revealed, was the fact that for the first time, point of use or mains-fed coolers (POU) held the majority share of slightly more than half of the market compared with bottled water coolers.

According to the latest figures released at this year’s annual British Water Cooler Association conference of the on 3 April 2014, the UK water cooler market has grown for the first time since 2007, against previous predictions.

The water cooler market on the UK increased from £109m in 2012 to £112m in 2013, with the total number of units having grown by 8%. Iva Hatzold stated that the increase was beyond expectations and attributed it to the good summer that the UK experienced in 2013 which saw a marked increased in the volume of consumption.

Whereas POU water coolers boosted sales in previous years, it seems that there was an increase in both bottled water coolers and mains water coolers since 2007.

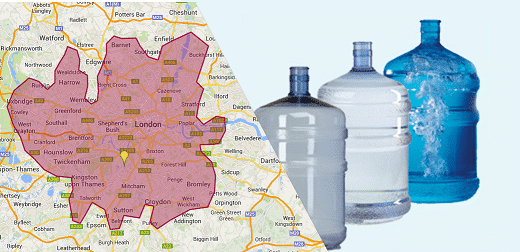

Bottled Water Coolers

Although the sale of bottled water cooler units was in decline, the decline was less than in previous years. Despite the sale of fewer units for installation, the overall bottled water cooler sector was not doing too badly.

Sales of water for bottled water coolers had increased by 1.8%. This was attributed to the increased consumption of water from bottled water coolers at construction sites and the fact that SMEs (small and medium sized enterprises) preferred the flexibility of bottled water coolers to mains water coolers.

The prediction of hotter summers in the UK in the future bodes well for this sector, as it is envisaged that sales of water for consumption will increase year on year.

Point of Use Water Coolers (POU)

The mains-fed or plumbed water cooler sector continues to see a slow-down, with fewer mains water coolers installed in 2013 than in 2012.

Two market sectors that are bucking the trend of smaller businesses investing in bottled water coolers over mains water coolers are retailers and hair & beauty salon sectors. Retail has traditionally been the smallest contributor to the POU market segment, but this seems to be changing due to the sector wanting to offer their customers improved service. Lack of space could be the reason for these two sectors preferring POUs over bottled water coolers.

While many companies are switching to POUs, the problem seems to be price, and this is causing many of them to switch indiscriminately from supplier to supplier. This has led to larger water companies targeting larger customers and smaller water companies targeting smaller businesses.

It would also seem that a big part of the problem with bottled water coolers is purely one of logistics, so it may pay water companies to concentrate on their delivery schedules and other after-sales services if they want to increase their share of the water cooler market.

Sources:

FoodBev.com